Stay with the question for a longer time!

Are Promoters free for strategic decisions?

Are you keen to transform to Process driven culture from person driven culture?

Are you struggling to scale up in spite of good external business environment?

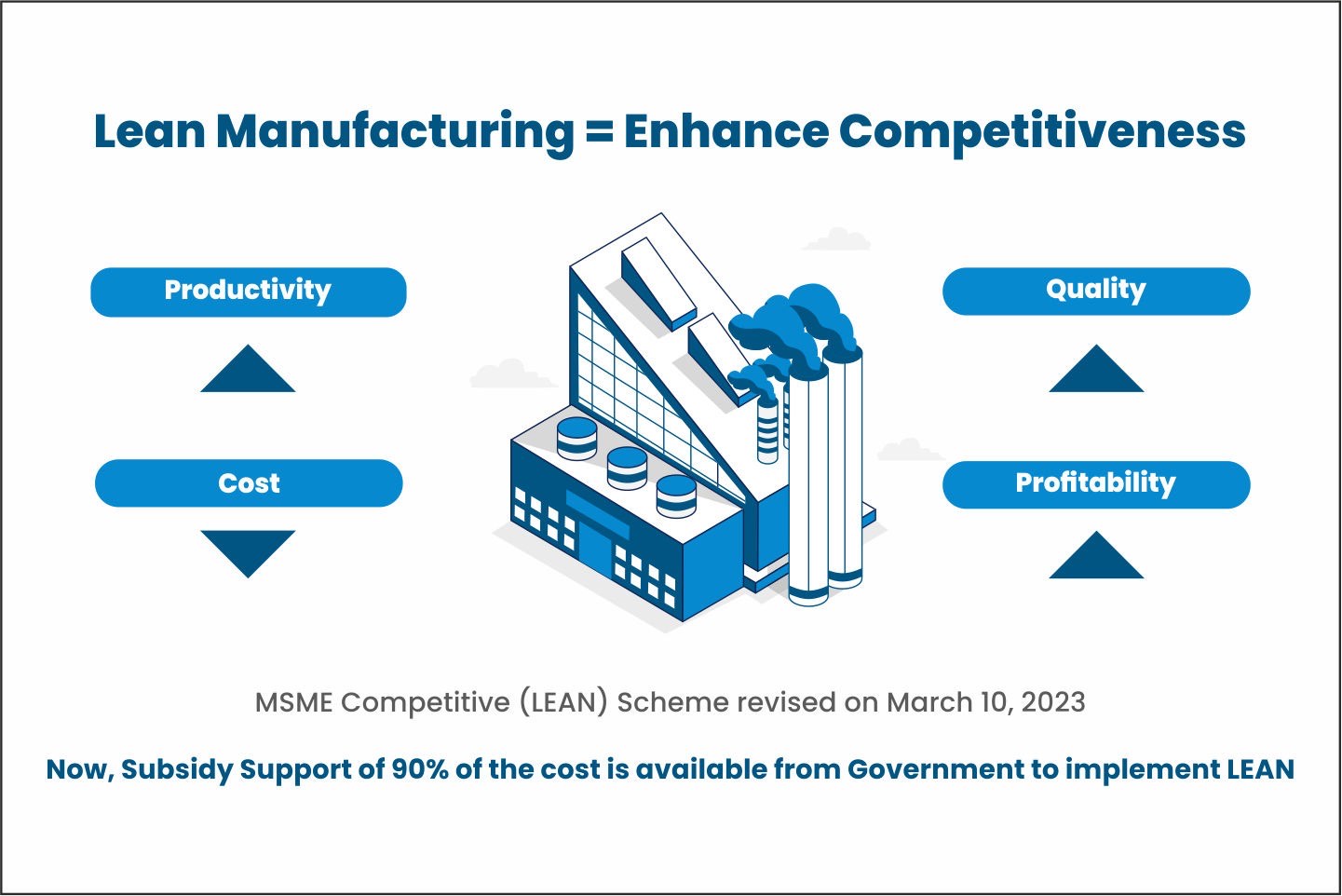

Is competitiveness for cost on your cards?

Do you believe in building your business by building your people?

Do you believe that a good performance management system will help your people to deliver better?

Do you need strong accounting, compliance & MIS support so that you can focus on important business challenges?

Does your business become more complex due to expansion & require exception reporting for management?

Do you need independent checks to ensure compliance to enhanced statutory requirements?

Do you feel the need to check IT & ERP systems?

Do your risk management practices sufficient for your business size?

Are you keen to develop an internal control framework needed for your organisation?

Do you feel that you are not able to devote required focus on important business challenges as you are too busy for accounting, compliance & MIS?

Is your organisation missing on analytics? The goal is to turn data into information, and information into insight. Turn Insight into Action.

Do you think you require an expert to help you on every aspect of Income Tax & GST?

Is your business requiring CFO expert as partner to board for key financial decisions for growth & improving profitability?