What is CGTMSE?

The first generation entrepreneurs, Micro & Small Enterprises (MSEs) do not have sufficient funds to finance their business and face the challenge of providing collateral security to the banks for extending credit facilities.

To extend credit facilities for such entities, Government of India launched Credit Guarantee Scheme (CGS) to strengthen credit delivery system and facilitate flow of credit to the Micro and Small Enterprises.

Subsequent to the enactment of MSMED Act-2006, the Trust was renamed as Credit Guarantee Funds Trust for Micro and Small Enterprises (CGTMSE).

What is the role of CGTMSE?

It provides the guarantee cover for the loan sanctioned by the member lending institution (MLI for a large portion of the loan amount.

Which borrowers are eligible under this scheme and up to which extent?

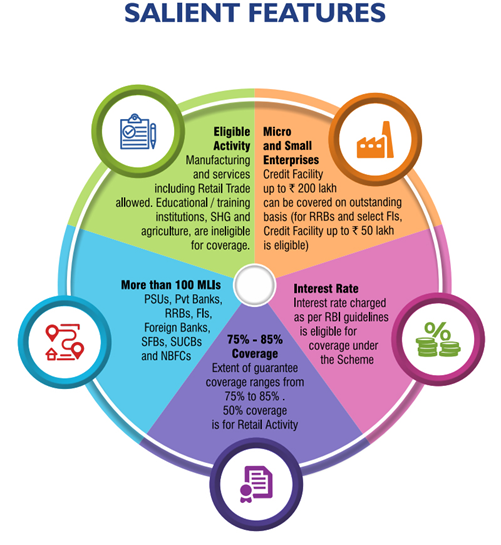

Both new and existing micro and small enterprises including service enterprises are eligible for a maximum credit of Rs. 2 crore.

Which are the lenders under this scheme?

Following are the lending institutions under this scheme;

- Scheduled Commercial Banks (SCBs)

- Regional Rural Banks (RRBs)

- Small Finance Banks (SFBs)

- Non-banking Financial Companies (NBFCs)

- Small Industrial Development Bank of India (SIDBI)

- National Small Industries Corporation (NSIC)

- North Eastern Development Finance Corporation Ltd. (NEDFi)

What are the key requirements for sanctioning loan under CGTMSE?

The basis of sanctioning loan is project viability and business model validation.

What are the steps involved for getting a loan under CGTMSE scheme?

Step 1. Formation of the Business Entity for new enterprises

Step 2. Preparation of Business Plan

Step 3. Sanction for Bank Loan

Step 4. Obtaining the Guarantee Cover

Documents required for loan under CGTMSE

Documents Required for Loan under CGTMSE and its coverage

- CGTMSE loan application form

- Passport-sized photographs

- Business Plan

- Business incorporation letter

- Company registration certificate*

- Business Project Report

- CGTMSE Loan Coverage Letter

- Copy of loan approval from bank

Is it necessary for the borrower to obtain all the credit facilities from a single MLI?

Credit facilities can be extended through more than one MLI jointly and / or separately to any eligible borrower.

What is guarantee coverage under CGTMSE?

|

Category |

Maximum extent of Guarantee where credit facility is |

||

|

Upto ₹ 5 lakh |

Above ₹ 5 lakh & upto ₹ 50 lakh |

Above ₹ 50 lakh & upto ₹ 200 lakh |

|

|

Micro Enterprises |

85%of the amount in default subject to a maximum of ₹ 4.25 lakh |

75% of the amount in default subject to a maximum of ₹ 37.50 lakh |

75% of the amount in default subject to a maximum of ₹ 150 lakh |

|

Women entrepreneurs/ Units located in North East Region (incl. Sikkim) (other than credit facility upto ₹ 5 lakh to micro enterprises) |

80% of the amount in default subject to a |

||

|

MSE Retail Trade (from ₹10 lakh upto ₹100 lakh) |

50% of the amount in default subject to a maximum of ₹ 50 lakh. |

||

|

All other eligible category of borrowers |

75% of the amount in default subject to a maximum of ₹ 150 lakh. |

||

When can the eligible lending institutions apply for guarantee cover in respect of eligible credit facilities under the scheme?

Eligible lending institutions have to enter into a one-time agreement with CGTMSE for becoming Member Lending Institutions (MLIs) of the trust. MLIs then can apply for a guarantee cover in respect of the eligible credit facility sanctioned to an eligible borrower. The MLIs can apply for a guarantee cover in respect of the credit proposals sanctioned in the quarter of April-June, July-September, October-December and January-March prior to expiry of the following quarter viz. July-September, October-December, January-March and April-June respectively.

What is the standard CGTMSE guarantee fee?

The standard CGTMSE annual guarantee fee is mentioned below:

|

Credit Facility |

Annual Guarantee Fee (AGF) [% p.a.]* |

|

|

Women, Micro Enterprises and Units covered in North East Region |

Others |

|

|

Up to ₹5 Lakh |

1.00 + Risk Premium as per extant guidelines of the Trust |

|

|

Above ₹5 Lakh and up to ₹50 Lakh |

1.35 + Risk Premium as per extant guidelines of the Trust |

1.50 + Risk Premium as per extant guidelines of the Trust |

|

Above ₹50 Lakh and up to ₹200 Lakh |

1.80 + Risk Premium as per extant guidelines of the Trust |

|

|

Retail Trade ₹10 Lakh and up to ₹100 Lakh |

2.00+ Risk Premium as per extant guidelines of the Trust |

|

|

* Annual guarantee fee will be charged on the guaranteed amount for the first year and on the outstanding amount for the remaining tenure of the credit facility. |

||

Is there any ceiling for the interest rate to be levied on the credit facility advanced to the borrower if the same is to be covered under CGTMSE?

The lending institution has to follow RBI guidelines related to the levied interest on micro and small enterprises. However, the interest rate on CGTMSE loan cannot exceed more than 4% over and above the base rate of the lender. This interest is exclusive from the payable fee to the trust, which is separate from the bank or financial institution’s lending rate.