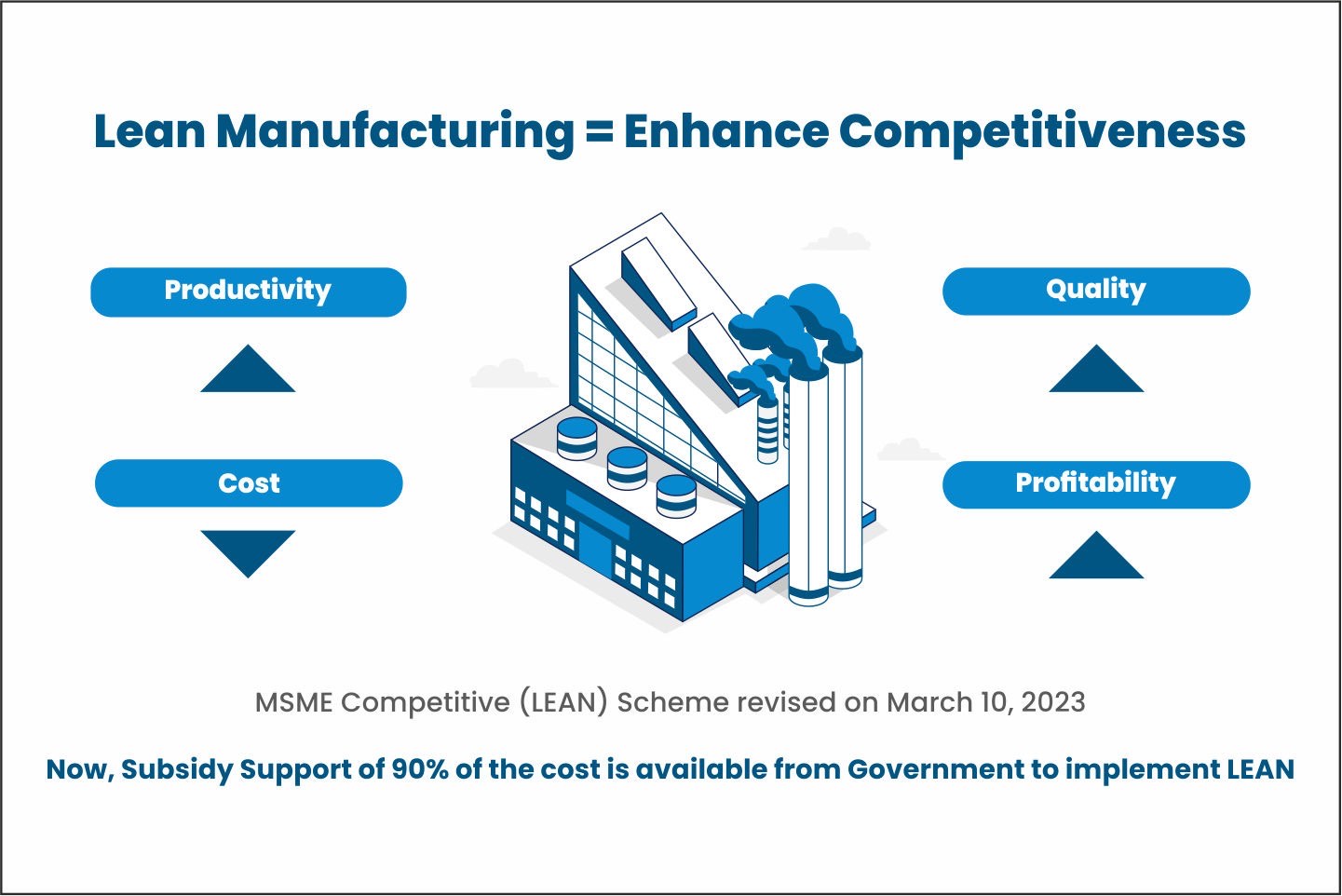

LEAN Manufacturing

Government of India has launched a revised version of the MSME Competitive (LEAN) Scheme on March 10, 2023 to aid micro, small, and medium-sized companies to improve their global competitiveness by utilizing LEAN manufacturing tools with the guidance of trained LEAN consultants.